The 2017 legislative session is in full swing. The Washington Business Alliance is actively tracking a number of bills pertaining to our PLAN Washington priorities in economy, education, environment, governance, health, and transportation. We are supportive of some of these bills, but many we are neutrally monitoring until more information becomes available.

Low Carbon Prosperity

Low Carbon Prosperity

The carbon pollution tax and investment act.

- House Bill 1555

- Lead Sponsor: Rep. Kristine Lytton (D)

- Status: House Finance

- Companion Senate Bill 5127

- Lead Sponsors: Senators John Braun (R) and Kevin Ranker (D)

- Status: Senate Ways and Means

Governor’s Request Legislation

Governor Inslee’s budget proposal contains a tax on carbon emissions associated with the production and consumption of fossil fuels in Washington State. Emissions generated by transportation fuels, electricity generation units, and natural gas consumption would be taxed beginning at $25 per ton starting May 2018. The rate of taxation increases annually by 3.5 percent, plus inflation. The tax is estimated to generate $1.9 billion in its first year and $2.0 billion in its second year.

Governor Inslee’s budget proposal contains a tax on carbon emissions associated with the production and consumption of fossil fuels in Washington State. Emissions generated by transportation fuels, electricity generation units, and natural gas consumption would be taxed beginning at $25 per ton starting May 2018. The rate of taxation increases annually by 3.5 percent, plus inflation. The tax is estimated to generate $1.9 billion in its first year and $2.0 billion in its second year.

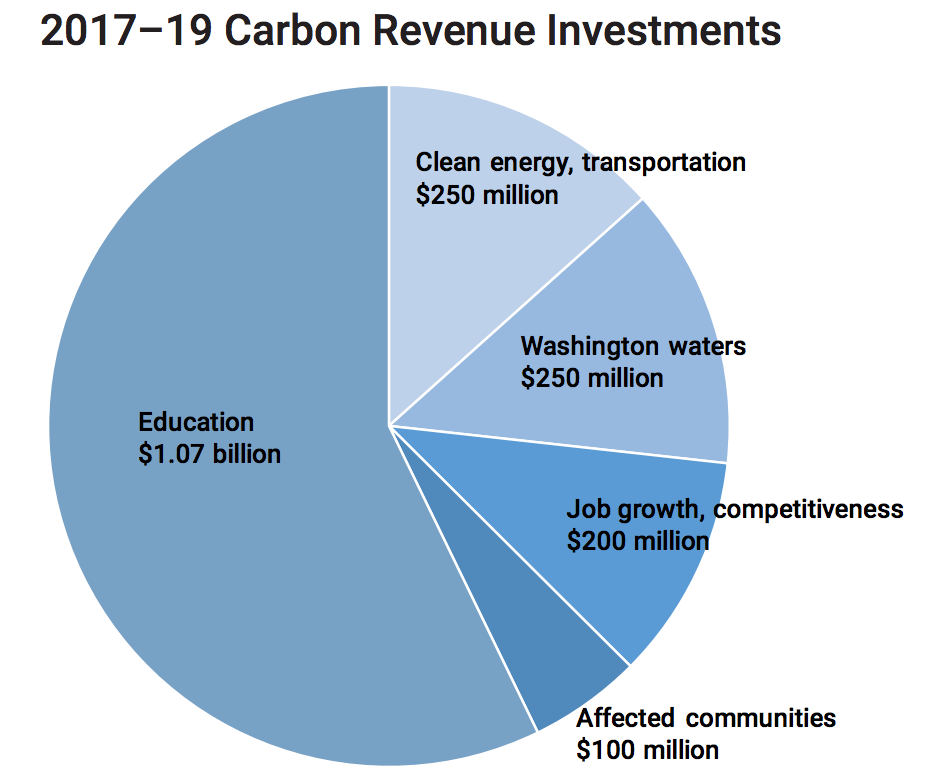

A majority of the revenues would be targeted towards K-12 education. According to the Governor’s Office, “about half the [the remaining portion of] revenues will go to energy efficiency, electrification of transportation, and other activities that will further cut greenhouse gas emissions in the state.”

InvestigateNW’s Adiel Kaplan wrote a piece for CrossCut about an exemption written into Inslee’s tax “for the state’s only coal-burning power plant, which is located near Centralia and is owned by the Canadian energy giant TransAlta.” The exemption is likely to create a price advantage for coal over cleaner-burning natural gas. Coal, which produces about twice the carbon dioxide of natural gas, is currently the more expensive of the two. A carbon tax might turn the tables, boosting coal burning in Centralia. Kaplan talked to Jim Lazar “a veteran Olympia-based energy consultant” who helped write November 2016’s Initiative 732. Lazar “calculates that in all likelihood, Inslee’s plan would cause Washington’s carbon footprint to increase slightly.”

Carbon pollution tax

- House Bill 1646

- Lead Sponsor: Rep. Joe Fitzgibbon

- Status: House Finance

- Senate Bill 5509

- Senators Reuven Carlyle (D) and Kevin Ranker (D)

- Status: Senate Energy & Environment

Promoting an equitable clean energy economy by creating a carbon tax that allows investment in clean energy, clean air, healthy forests, and Washington’s communities.

Crosscut — Adiel Kaplan, InvestigateNW: “A variation on a carbon tax crafted by the Alliance for Jobs and Clean Energy, and one backed by all the major environmental groups, which opposed the tax on the November ballot because it failed to raise revenue for the state. Fitzgibbon’s bill would not direct any funds from the carbon tax toward education, instead focusing them on transitioning to a clean energy economy.”

The Lens — Matt Rosenberg: “Major carbon emitters have filed suit to block Inslee’s [carbon capping] Clean Air Rule … It was enacted administratively through Ecology last year, and takes effect this year. Fitzgibbon … underscored to The Lens a point he has emphasized before; that a carbon tax is a free-market mechanism, and if legislators and stakeholders can work out a deal, a key component could be to override the current Clean Air Rule.”

Fossil fuel carbon pollution tax

- Senate Bill 5385

- Lead Sponsor: Senator Hobbs (D)

- Status: Senate Energy & Environment

This bill creates a tax on tax on the carbon content of fossil fuels at $15 per ton. It also eliminates the Clean Air Rule created by Governor Inslee and the state Department of Ecology. Indirectly supports Basic Education by funding K-12 transportation.

Revenues from the tax would be directs as follows:

- 50% for multimodal transportation account for local K-12 school district student transportation.

- 15% for projects to reduce impact of stormwater from existing infrastructure and development.

- 15% for fish habitat restoration projects.

- 15% for programs that advance energy efficiency and renewables.

- 5% for highway maintenance and preservation

Crosscut: “Hobb’s bill is less detailed than Inslee’s and Fitzgibbon’s proposals. His tax is smaller and focuses a large portion of the revenue on funding transportation programs, including for schools.”

New greenhouse gas emissions reduction targets

- Senate Bill 5421

- Status: Senate Energy & Environment

- Lead Sponsor: Senator Maralyn Chase (D)

Deepens reduction targets originally set by the state legislature in 2008 for limiting emissions of greenhouse gases.

From the bill: “In 2008 the legislature adopted statewide greenhouse gas emission limits to provide leadership in mitigating the potential adverse climate change… These limits were based upon the best scientific information then available. The legislature also directed that… the state Department of Ecology must report to the legislature and make recommendations regarding whether these statewide emission limits should be updated. Recently the Department of Ecology has reported to the legislature and recommends revising the 2035 limit from twenty-five percent below 1990 emission levels to forty percent below 1990 emission levels. In addition, within the 2016 Paris agreement… the United States has pledged reductions over the next decade that exceed those adopted by the legislature through this time period… Therefore, it is the intent of the legislature to strengthen the state’s emission limits to be consistent with the reductions pledged by the United States at the Paris agreement and in addition to strengthen the 2035 emission limits to ensure the state continues to contribute its fair share of emission reductions to mitigate climate change impacts.”

Nuclear energy state strategy

- Senate Bill 5468

- Lead Sponsor: Senator Sharon Brown (R)

- Status: Senate Energy & Environment

Including nuclear energy in the principles that guide development and implementation of the state’s energy strategy.

Small modular reactors tax exemption

- Senate Bill 5475

- Lead Sponsor: Senator Sharon Brown (R)

- Status: Senate Energy & Environment

Providing a business and occupation tax exemption for manufacturers of small modular reactors.

Related Reading: “Are Washington Lawmakers Jumping the Gun on Nuclear Energy?” by Caroline Halter

Statewide Growth

Statewide Growth

Washington Rural Jobs Act

- House Bill 1422

- Lead Sponsor: Reps. Brian Blake (D) and Jim Walsh (R)

- Status: House Technology & Economic Development

- Companion Senate Bill 5208

- Lead Sponsor: Senators Judy Warnick (R) and Dean Takko (D)

- Status: Senate Agriculture, Water, Trade & Economic Development

Requires the department of commerce to accept applications for approval as a rural growth fund. Allows a nonrefundable tax credit, for taxpayers that made a credit- eligible capital contribution to the rural growth fund and were issued a tax credit certificate, and allows the credit to be claimed against the following: Business and occupation taxes; insurance premium taxes; and retaliatory taxes. Provides a July 1, 2023, contingent expiration date.

Port district worker development

- House Bill 1510

- Status: House Technology & Economic Development

- Lead Sponsor: Rep. Gael Tarleton (D)

- Business Alliance position: Support

Requires ports that are seeking to engage in port district worker development and occupational training programs to declare that port-related workforce development provides a substantial public benefit consistent with the port commission’s economic development goals.

Statewide Tourism Marketing Act

- House Bill 1123

- Lead Sponsor: Reps. Cary Condotta (R) and Cindy Ryu (D)

- Status: House Community Development, Housing & Tribal Affairs

- Companion Senate Bill 525

- Lead Sponsor: Senators Dean Takko (D) and Judy Warnick (R)

- Status: Senate Agriculture, Water, Trade & Economic Development

- Business Alliance position: Support

Creates the Washington tourism marketing authority to act as a business management organization on behalf of the citizens of the state to manage financial resources and contract for statewide tourism marketing services. Requires the joint legislative audit and review committee to conduct an evaluation of the performance of the authority to determine the extent to which the authority has contributed to the growth of the tourism industry and economic development of the state. Creates the statewide tourism marketing account.

Summary of Supporting Testimony: “ Washington is the only state without a statewide tourism marketing program, and tourism is important and critical to the vitality of Washington. Currently, Washington has some amazing assets and has the ability to compete with other states, but these assets need to be marketed, so the state benefits fully from tax revenues from these industries. Other states are marketing aggressively, and without an investment in tourism, Washington will continue to lose out on these market shares. Local industries, including restaurants, hoteliers, and shop owners are hoping to market Washington because other states are outpacing Washington’s tourism efforts. By investing in tourism, Washington is guaranteed a return on tourism and has the potential for huge economic growth statewide and locally. Rural communities in Washington have experienced significant natural disasters and it is important to these communities to have a partner at the state level… An increase in tourism could stimulate economic growth and be a job creator for rural communities.”

Josh McDonald, Washington Wine Institute: “Walla Walla is known as one of the worldwide tourist destinations for wine… Our industry can bring tourists and tourist dollars into our state. I think it can do a tremendous amount of good for our local, rural economies.”

Shiloh Schauer, Wenatchee Valley Chamber: “We have had some significant natural disasters in our area. It’s really important that we have a partner at the state level to help get our community’s message out.”

The Lens — Mike Richards: “House Bill 1123… would create a two-to-one private-public funding partnership of up to $15 million per biennium to promote the whole state to domestic and international visitors… State funding would come not through any tax hike, but via a .1 percent slice of existing revenues from sales taxes on lodgings, car rentals and restaurant meals… HB 1123 would fill the gap left after 2011, when legislative funding for statewide tourism had dwindled to a small fraction of its previous level. Supporters argue ramping back up, especially with the envisioned two-to-one private-public funding formula, would generate a strong return on investment from an industry which already yields $21 billion in direct and indirect spending each year in Washington.”

Manufacturing and industrial property tax exemption in target areas

- Senate Bill 5204

- Lead Sponsor: Joe Fain (R)

- Status: Senate Ways & Means

Modifying a property tax exemption for industrial and manufacturing industries in targeted areas. Addresses industrial and manufacturing industries in targeted areas with regard to the modification of a property tax exemption for those industries.

Career Tech Education

Career Tech Education

Strengthen Funding for Career Tech Education

- Senate Bill 5183

- Lead Sponsor: Senators Christine Rolfes (D) and Ann Rivers (R)Status: Senate Early Learning & K-12

- Companion House Bill 1282

- Lead Sponsor: Reps. Gael Tarleton (D) and Matt Manweller ®

- Status: House Appropriations

- Business Alliance position: Support

Ties the career and technical funding for materials, supplies, and operating costs to the general education funding for materials, supplies, and operating costs by setting a rate for career and technical education that is equal to a specified multiplier of the general education funding.

Modifying credit requirements for high school graduation

- House Bill 1509

- Lead Sponsors: Reps. Monica Stonier (D) and Paul Harris (R)Status: House Committee on Education

- Business Alliance Position: Support

Eliminates, for the graduating classes of 2019 onward, the twenty-four credit graduation requirement and establishes a twenty-one credit requirement for graduation with delineated credit requirements by course type.

WA-ACTE: “This year’s Juniors and Seniors have 20 credits required for Graduation.

Students have room in their schedules to transport to a skills center for a half day, or even go to a Technical College for a Running Start program, both without leaving High School counselors scratching their heads, wondering how to check all the 24 boxes in order to grant a High School diploma.

Aren’t students obviously college and career ready, if they are earning college-level, industry-recognized, technical certificates? And yet counselors hesitate to tell students about these opportunities, worried about missing a box on the new high school diploma check list.

Our current Sophomores and Freshman have 4 more year-long courses added to their graduation requirements. This is limiting their ability to take career based classes, in order to prepare them for the world of work and meaningful post-high school learning opportunities.

We are hearing this from CTE Directors statewide.

The intent of the 24 credit requirements was to allow flexibility in how the math, science, and English were delivered. At the implementation level, schools are struggling with how to provide individualized, student directed, career based opportunities, and check all 24 boxes at the same time.

By moving from 20 to 21 credits for our High School students, we will still be able to allow career exploration and applied learning opportunities in High Schools, Skills Centers, and Community and Technical Colleges across the state. 24 credits has unintentionally narrowed opportunity and choice for students. Our promise is to prepare all students for career, college, and life. HB 1509 helps us get there.”

One Washington: Education Equality Act

Recently approved by the Senate in a narrow 25-24 vote, the Senate GOP’s Education Equality Act lays out a massive shift in K-12 funding and how it connects to the state’s property tax system. It would repeal the “prototypical schools model” for funding and replace it with a statewide per-pupil funding system. A minimum of $12,500 in funding would be tied to each student with additional funding provided based on unique student needs:

- $2-5,000 for student from low-income family

- $7,500 for special education student

- $1,000 for English language learners

- $1,500 for homeless students

- $500 for students enrolled in Career & Technical Education and Skill Centers

These changes would take place in the 2018-19 school year.

Due to the McCleary showdown lawmakers are facing a “levy cliff,” a State Supreme Court mandated reduction in how much money school districts can collect through local property tax levies. The Democratic-controlled House voted to approve HB 1059, with some Republicans joining. Their bill would extend the current taxing authority for school district till January 2019.

The plan from Senate Republicans would address these issues through a new statewide property tax levy to fund K-12. This new permanent tax, capped at $1.80 per $1,000 of assessed property value, would be added to the current property tax levy of roughly $1.90 per $1,000 of assessed value. Sponsors of the Education Equality Act estimate it would add about $1.4 billion in new education dollars every two years.

The Spokesman-Review: “The GOP plan would reduce property taxes for many residents in 2019 by eliminating the current maintenance and operations levy for school districts and instituting a new statewide property tax levy. School districts would get a minimum of $12,500 per student under a new and complicated formula that takes into account needs like special education, English as a second language and homelessness… Senate Democrats agreed that it was a significant and perhaps once-in-a-generation change in the way the state collects taxes for schools, but they weren’t ready to sign on to it yet.”

The bill includes a “Hold Harmless” provision for small schools. Any school with an enrollment below 2,500 students would receive the amount they are projected to receive under current law if that amount is larger than their allotment under the new law.

State Superintendent Chris Reykdal released a statement immediately praising the effort. Reykdal said “the proposal shows that Republicans are serious about solving the funding problem.” He said their plan demonstrated an understanding that additional revenue was necessary.

“The proposal itself is very comprehensive,” according to Reykdal. “I appreciate the emphasis on accountability and on providing additional support for underachieving students… I also appreciate the emphasis on teacher recruitment and retention. We have a critical teacher shortage caused, in part, because all teachers need market pay.” He pledged “to work with the House and Senate to create a bipartisan solution that improves student achievement, empowers educators and maximizes local control.”

The Senate bill repeals Initiative 1351. I-1351 was passed by voters in 2014 to reduce class sizes throughout the K-12 system. Class size reductions would instead be targeted on grades K-3. Research strongly suggest the greatest benefits from reducing class sizes accrue for disadvantaged students in grades K-3.

Senator Hans Zeiger (R), Chair of the Senate K-12 & Early Learning Committee, expressed his satisfaction upon the bill’s passage through the Senate. “For decades, we’ve been far too reliant on local property tax levies and far too focused on protecting the status quo in our education system,” Zeiger wrote via Facebook. “Today in the Senate, we took a big step in the right direction by passing an ambitious reform plan that sets a per-pupil funding amount, sets standards and holds school districts accountable while giving them more operational flexibility, and establishes a flat property tax across Washington to pay for the plan.”

The bill has it’s detractors. The statewide teachers’ union (Washington Education Association or WEA) released a seriesstatements slamming the Senate proposal as a “reckless and punitive move” within a “Trump-DeVos style budget.” WEA criticized the proposal for containing what it labelled “a levy swap” increasing taxes in some districts and sending the increased funding to other districts. According to WEA, “a number of districts representing a total of 500,000 students would receive less funding than what they currently receive, and taxpayers in Seattle would pay $174 million more and get $2 million in return.”

WEA threw its support behind Gov. Inslee’s K-12 budget. It criticized OSPI head Chris Reykdal for his qualified support of the Senate’s proposal. WEA’s strong opposition is in part fueled by provisions in the Senate plan which provide school districts flexibility to hire non-traditional teachers, provide new incentive structures, and implement new processes to identify and remove teachers detrimental to student learning. Democratic Senator Lisa Wellman expressed her objections to the bill. It’s “loaded with elements I cannot support,” said Wellman. “Included is a provision for allowing anyone passing a background check to teach your kids. No certification. No Education degree. This is disrespectful to the talented, committed men and women in the profession.”

Passed by the state Senate on Feb. 1st, 2017, the Majority Coalition Caucus proposal now moves on to the Democratic-controlled House, where it will be the basis of negotiation as both parties continue working toward a compromise.

Washington Policy Center — Summary

Higher education infrastructure investment program

- Senate Bill 5684

- Lead Sponsors: Senators Guy Palumbo (D) and Lynda Wilson (R)

- Status: Senate Committee on Higher Education

Creates the Higher Education Infrastructure Program. The purpose of the Program is to leverage state spending on capital projects in high-demand fields of study in partnership with Washington employers.

Promoting agriculture science education in schools

- Senate Bill 5318

- Lead Sponsor: Senator Sam Hunt (D)Status: Senate Early Learning & K-12

- Companion House Bill 1453

- Lead Sponsor: Rep. Brian Blake (D)

- Status: House Committee on Education

Directs OSPI to designate one or more high schools to serve as lighthouse programs on how to combine agriculture science education with a focus on STEM and partnerships with businesses and the community.

Creates the Agriculture Science Education Grant Program to award grants to provide professional development for certificated instructors, obtain consumable laboratory equipment supplies, acquire equipment commonly used in the agriculture industry, and cover administrative costs.

Working Forests

Working Forests

Forest riparian easement program

- House Bill 1531

- Lead Sponsor: Reps. Mike Chapman (D) and Richard DeBolt (R)

- Status: House Agriculture & Natural Resources

- Companion Senate Bill 5394

- Lead Sponsor: Senators Ann Rivers (R) and Dean Takko (D)

- Status: Senate Natural Resources

Expands the definition of qualifying timber under the Forest Riparian Easement Program to include timber that the owner is required to leave unharvested by the forest practices rules.

Directs the Department of Natural Resources to share information regarding the carbon storage benefits of the Forest Riparian Easement Program with other state programs, and to promote the expansion of the Forest Riparian Easement Program as part of the state’s climate strategy

Background: The Forest Riparian Easement Program is a program managed by the Department of Natural Resources to acquire 50-year easements along riparian and other sensitive aquatic areas from small forest landowners who are willing to sell or donate easements to the state.

Cross-laminated timber in public buildings

- Senate Bill 5379

- Lead Sponsor: Senator John McCoy (D)

- Status: Senate State Government

Constructing all new public buildings with cross-laminated timber.

Requires new public buildings that are twelve stories or less to be constructed with cross-laminated timber. Allows the department of enterprise services to grant a waiver to a public agency or a municipality from the requirements mentioned above.

Learn more about Washington State’s cross-laminated timber opportunity

Cross-laminated timber

- Senate Bill 5450

- Lead Sponsor: Senators Marko Liias (D) and Judy Warnick (R)

- Status: Senate Local Government

Requires the State Building Code Council to adopt rules for the use of cross-laminated timber (CLT) products for building construction.

- Background: CLT is a wood panel consisting of three, five, or seven layers of dimensional lumber oriented at right angles to one another and then glued to form structural panels. Because of the strength and stability of CLT, it is increasingly used as an alternative for traditional structural materials, e.g., steel, concrete, and masonry. The State Building Code establishes minimum performance standards and requirements for construction and construction materials in the state, consistent with accepted standards of engineering, fire, and life safety. The State Building Code Council is responsible for adopting, amending, and maintaining the model codes and standards adopted by reference in the Act.

Government That Works

Government That Works

Government performance

- Senate Bill 5065

- Senator Mark Miloscia (R)

- Status: Senate State Government

Establishes the Office of Performance Management within the office of the Governor, tasked with implementing a state strategic plan, assisting state agencies with Lean Management implementation, and partnering with organizations to conduct excellence assessments of state agencies.

Requires each state agency to adopt a strategic plan and conduct excellence assessments in coordination with OPM.

- Background: Approximately ten states, including Washington, have established central offices to promote Lean performance management principles and programs in state agencies. Originally developed by Japanese corporations, Lean principles seek to increase efficiency and eliminate waste and inefficiency in operations, based upon continuous assessment and improvement. Washington’s office, Results Washington, was created by Governor Jay Inslee in a 2013 Executive Order, and operates within the Governor’s Office. Results Washington is headed by an appointed director and includes 12 full-time employees. An additional five employees from other agencies participate in year-long fellowships in which they learn Lean principles that may be applied in their agencies.

- Summary of Sen. Miloscia’s testimony in support of SB 5065: In many state agencies, there is no functioning Lean program or quality management. The goal of this bill is to improve state agency performance so that we have the most ethical, efficient, and effective agencies in the nation. Language in the bill… includes audit requirements, which are essential to ensure that agencies are working well.

Zero-based budget reviews

- Senate Bill 5066

- Senator Mark Miloscia (R)

- Status: Senate State Government

- Business Alliance position: Support

Establishes the zero-based budget review process to provide more thorough analysis of the programs and services provided by state agencies and to better prioritize the expenditure of public resources.

McKinsey —Five myths and realities of Zero Based Budgeting: “Zero-based budgeting is a repeatable process that organizations use to rigorously review every dollar in the annual budget, manage financial performance on a [regular] basis, and build a culture of cost management among all employees.”

Government Finance Officers AssociationZero-Based Budgeting: Modern Experiences & Current Perspectives: “When using zero-base budgeting (ZBB), a government builds a budget from the ground up, starting from zero… ZBB has seen renewed interest in today’s environment of fiscal constraint, not least because the “zero” in zero-base budgeting sends a powerful message that taxes and spending will be held in check… ZBB promises to move the organization away from incremental budgeting, starting from zero, with the implication that past patterns of spending are no longer taken as a given.”

Transportation

Transportation

Public-private partnership best practices for non-toll transportation projects.

- Senate Bill 5330

- Status: Senate Transportation

- Lead Sponsor: Senators Hans Zeiger (R) and Guy Palumbo (D)

- Business Alliance position: Support

Implementing public-private partnership best practices for non-toll transportation projects.

States that the legislature intends that the review process, criteria, and approvals for public-private partnership projects involving toll-related facilities remain unchanged, but that the review and approval process for non-toll projects be modified so that the criteria and review process can be more closely tailored to the specific type of proposed non-toll project or program.

In 2005 the State phased out the original P3 framework (created in 1993) and replaced it with a new P3 law known as the Transportation Innovative Partnerships Act. This legislation has not fully met the needs and expectations of the public or private sectors for the development of transportation projects. It’s time to move forward with a more flexible and effective approach to developing transportation P3s which draws on lessons learned from other states and our own 10+ years of experience under the current framework.

P3s are often presented as merely a matter of bringing private capital into public projects. The fact is that what the private sector has to offer goes far beyond money. They have capacity to innovate and expertise in design, building, maintenance, and operations that can increase efficiency and enhance outcomes. The goal here is public-private collaboration to optimize the performance of publicly-owned assets.

When done well, P3s can pencil out favorably for taxpayers. On the financing side, they can enable projects to get started sooner versus later or never. There can be substantial economic and social benefits of getting something built years sooner — acting before inflation raises prices, avoiding congestion, seizing business opportunities, and reducing emissions from idling vehicles. If P3s can open the door to projects which increase freight mobility, they can boost our economy by helping speed the movement of goods from origin to destination.

The state’s population is expected to grow massively over the coming decades. Meeting future needs will require rethinking how the state designs, builds, manages, maintains, and (yes) finances its transportation system: roads, freight rail, marine, and transit.

Washington’s P3 project review and approval process could benefit from statutory modifications aimed at streamlining the process while maintaining public interest safeguards. SB 5330 is a modest step towards that goal — providing a limited pathway to explore opportunities.

Transportation electrification

- House Bill 1335

- House Technology & Economic Development

- Lead Sponsor: Rep. Gael Tarleton

Authorizes certain cities and towns, engaged in the generation, sale, or distribution of energy, to: (1) Assist its customers in financing the acquisition and installation of materials and equipment for the electrification of transportation; and (2) Offer programs, services, or investments in the electrification of transportation for its customers in a way as to benefit ratepayers, pursuant to an electrification of transportation plan adopted by the governing body of the city or town.

Expands EV incentive authority (granted to private utilities in 2016) to Seattle City Light.