A group of western states states are stepping up “collaborative research into systems and policy development” that could help pave the way for long-term implementation of a mileage-based vehicle tax to replace the by-the-gallon gas tax made increasingly ineffective by more fuel-efficient vehicles. This comes as leaders in the effort, Washington and Oregon, are clearly moving away from mandating a GPS-like “black box” on-board device to report mileage and even routes used and time of day. GPS could still be an option, but only if the driver chooses.

Meanwhile the head of the Washington State Transportation Commission says some form of mileage tax – or road usage charge, as the state calls it – is looking more likely. “This seems to have some momentum because it seems to be a very fair way of assessing and gaining the revenue that’s necessary to maintain the system,” WSTC Chair Tom Cowan recently told Drew Mikkelsen of KING5-TV in Seattle.

Along with a GPS-powered “differentiated distance charge” system which could be operated by state contractors subject to strict limits on driver data confidentiality, other approaches being explored in Washington will include an odometer charge based on prepayment for estimated travel miles with reconciliation of the balance later; and something more removed from the mileage tax concept called a “time permit” based on a flat annual fee to correspond with the 95th or 98th percentile of per-vehicle annual miles driven in the state.

This would be the simplest approach but wouldn’t distinguish between light and heavy users nor allow discounts based on use of less congested roads or driving at off-peak hours – important calibrations all possible with on-board GPS. An odometer charge in Washington wouldn’t differentiate between miles drive in-state or out-of-state, meaning wear and tear from Washington-registered vehicles on roads in an adjoining state would result in payments to Washington.

Western Road Usage Charge Consortium Growing

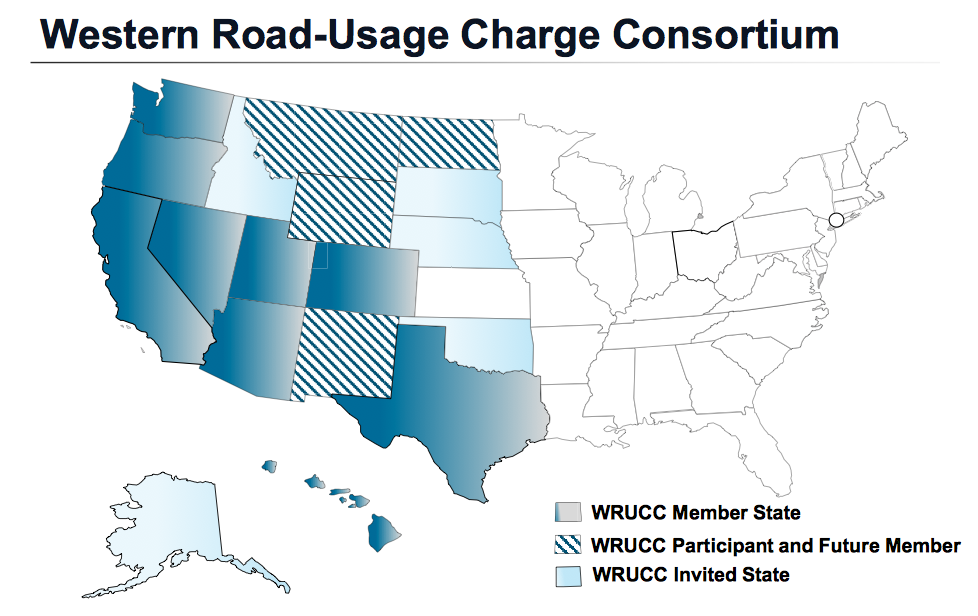

To ratchet up dialog and joint planning around such implementation challenges, 11 states have already joined the Western Road Usage Charge Consortium or WRUCC. Three more are planning to join, and three more have been invited. WRUCC Administrator Randal Thomas of the Oregon Department of Transportation, says the body is “a group of western states that are banding together to jointly explore and understand the implications of RUC” and “undertake collaborative research into systems and policy development…” He stresses that actual policy and implementation decisions will be left to individual states.

Road usage charging policy will also be the subject of two sessions July 14 at the 2014 “Crossroads to the Future” annual meeting of the Western Association of State Highway and Transportation Officials in Albuquerque.

- From “Washington State Road Usage Charge Assessment, Transportation Commission Briefing,” 6/17/14; (Note: MT & ID have subsequently joined WRUCC)

In Oregon, the state is building on mileage tax pilot projects in 2007 and 2012. Following passage of SB 810 last year Oregon is set to implement a more extensive and final road usage charge pilot test of 5,000 drivers starting July 1, 2015 and is currently seeking vendors. This last pilot test would clear the path for a legislative decision authorizing “mandatory mileage charges where people are obligated to pay,” James Whitty, Manager of the Office of Innovative Partnerships and Alternative Funding for ODOT, told the Reason Foundation’s Leonard Gilroy in an interview earlier this year.

Oregon Likes “Open System Model”

In the interview with Gilroy, Whitty stressed Oregon’s growing experience with road usage charging shows that driver choice is crucial. After the initial pilot focused on use of GPS box and at-the-pump account reconciliation, “we moved to the open system model, allowing the marketplace to provide the technologies and giving motorists choices for how they report their miles…Some people could choose to report all their miles without any kind of vehicle location capability, others could use GPS if they wanted to” or they could switch back and forth, or opt for a flat fee, Whitty told Gilroy.

Whitty added that the 2012 Oregon pilot “was much simpler and more a product of the age we’re in with iPhones, Wi-Fi, 4G and cloud-based computing…it relies on machine-to-machine communications. Hopping on the ‘Internet of things’ is…more acceptable to people” than mandated on-board GPS, Whitty said.

California is getting into the act too, as a member of the WRUCC. According to a staff memo from the state transportation commission’s Executive Director Andre Boutros, the move is intended “to explore..the technical and operational feasibility of a multi-jurisdictional mileage based usage charge system; investigate public and key decision maker criteria for acceptance; share experiences and lessons learned; (and) develop operational standards and protocols…”

Further signaling California’s interest the State Senate passed this June a bill – SB 1077 – to authorize a voluntary road usage charge pilot by 2016. After senate action, the bill then cleared the state assembly’s transportation committee and has been referred to the appropriations committee.

- James Whitty, ODOT Office of Innovative Partnerships & Alternative Funding

The preamble of SB 1077 acknowledges “the inadequacy of the gas tax to meet California’s long-term revenue needs for transportation and the need to explore an MBF (mileage-based fee) program as an alternative to the antiquated gas tax system now in place.”

Dan Walters: Why California Needs Road Usage Charging

Veteran California statehouse columnist Dan Walters of the McClatchy newspaper chain wrote recently, “….an ideological disdain for highways among liberals, combined with an equally fierce dislike of taxes among conservatives, has been a recipe for political neglect. California’s vehicular travel has doubled during the last 30 years, but fuel consumption has risen by only one-third – good news overall but bad news for our battered highways. A long-standing tax system based on fuel volume has become obsolete as autos have become more fuel-efficient. Meanwhile, electric vehicles bypass tax-collecting fuel pumps altogether, even though they add to congestion and highway wear. Inflation compounds the crisis.”

Walters continued, “…Basing road revenue on fuel gallonage, or even prices, is no longer realistic, and we should shift to mileage-based financing. It’s kicked around transportation circles for decades, but is gaining new traction among highway advocates…SB 1077 is just a baby step, and given the underlying political divisions, it may lead nowhere, even if the Assembly approves the bill. But it’s a start. Highways are not improving with age.”

The 11 current members of the WRUCC are Hawaii, Washington, Oregon, California, Montana, Idaho, Nevada, Utah, Arizona, Colorado and Texas. To join are North Dakota, Wyoming and New Mexico. Invited are South Dakota, Nebraska and Oklahoma.

D.C. Advocacy Group Backing Road Usage Charging, Too

In addition to the consortium of western states interested in cooperating on road usage charging, there is a Washington, D.C.-headquartered non-profit called the Mileage Based User Fee Association which “brings together government, business, academic and transportation policy leaders to conduct education and outreach on the potential for mileage-based user fees as an alternative for future funding and improved performance of the U.S. transportation system.”

Next Recommendations to Inslee, WA Lawmakers in January

The current phase of Washington’s Road Usage Charge Assessment, overseen by the state transportation commission and funded earlier this year by the legislature with $450,000, will result in formal recommendations next January to Governor Jay Inslee and the legislature. A major deliverable will be a preferred concept of operations, including a financial analysis and one or two transition strategies from the current gas tax, which may be raised once more by lawmakers before any phase-out.

An update from consultants at the Washington state commission’s June meeting noted that a March 2014 legislative amendment to the transportation budget directed the current study phase include assessments by the commission on the rural-urban equity implications of a road usage charge, and an assessment by the Washington State Department of Transportation and the State Treasurer of “impacts on fuel tax bond holders” who’ve already loaned transportation project money to the state based on repayment of principal and interest backed by expected revenues from the current gas tax.

The road user charge would likely be applied to all vehicles weighing less than 10,000 pounds, meaning cars and some light trucks, but not freight haulers who would still pay the diesel fuel tax.

PSRC: Seattle-Area Pilot Program in ’05-’06 Showed Benefits

A road usage charge pilot test in Washington could unfold as early as 2016. Some southwest Washington drivers participated in the 2012 Oregon pilot, and the Puget Sound Regional Council ran a federally-funded Seattle-area pilot program in 2005-06.

It involved study-funded user charge accounts, and on-board GPS units enabling simulated system-wide electronic tolling of the volunteer participants with variable rates applied based on specific road used and time of day or night. Users were incentivized to drive as much they needed to but also to preserve as much they could of the money pre-loaded into their accounts.

The pilot system processed 4.5 million vehicle miles travelled via 750,000 trip records, 100,000 vehicle-to-central-system wireless data transmissions, and the issuance of 4,000 simulated invoices.

That probe found a positive impact from the charging scheme. The PSRC reported: “Analysis of the data revealed important changes in household driving patterns that could significantly reduce congestion if variable tolling were implemented within a regional road network. Many households made notable changes in their travel practices. Households that modified their travel did so in many different ways: taking fewer and shorter vehicle trips, choosing alternate routes and times of travel, or linking trips together to reduce vehicle use altogether.”

The PSRC report concluded, “The Traffic Choices Study was not designed to make the case for variable road tolling. The study was based on an expectation that road users would respond to price, and that the specific choices road users make determine whether variable road tolling is a useful approach to road finance and management. However, the case for road tolling is compelling. The study endeavored to also document the problems associated with tolling an entire network of road facilities; it would be complex and costly, the technology raises concerns about privacy, and some fear the charges would be particularly burdensome to particular users. Yet the opportunities to limit roadway congestion (and its wasted resources) and address the inefficiency and instability of current finance methods are significant and merit serious consideration in the development of future transportation financing policy.”

RELATED:

PLAN Washington Transportation Strategies, Washington Business Alliance