Updates from our policy advisors in Olympia

Low Carbon Prosperity

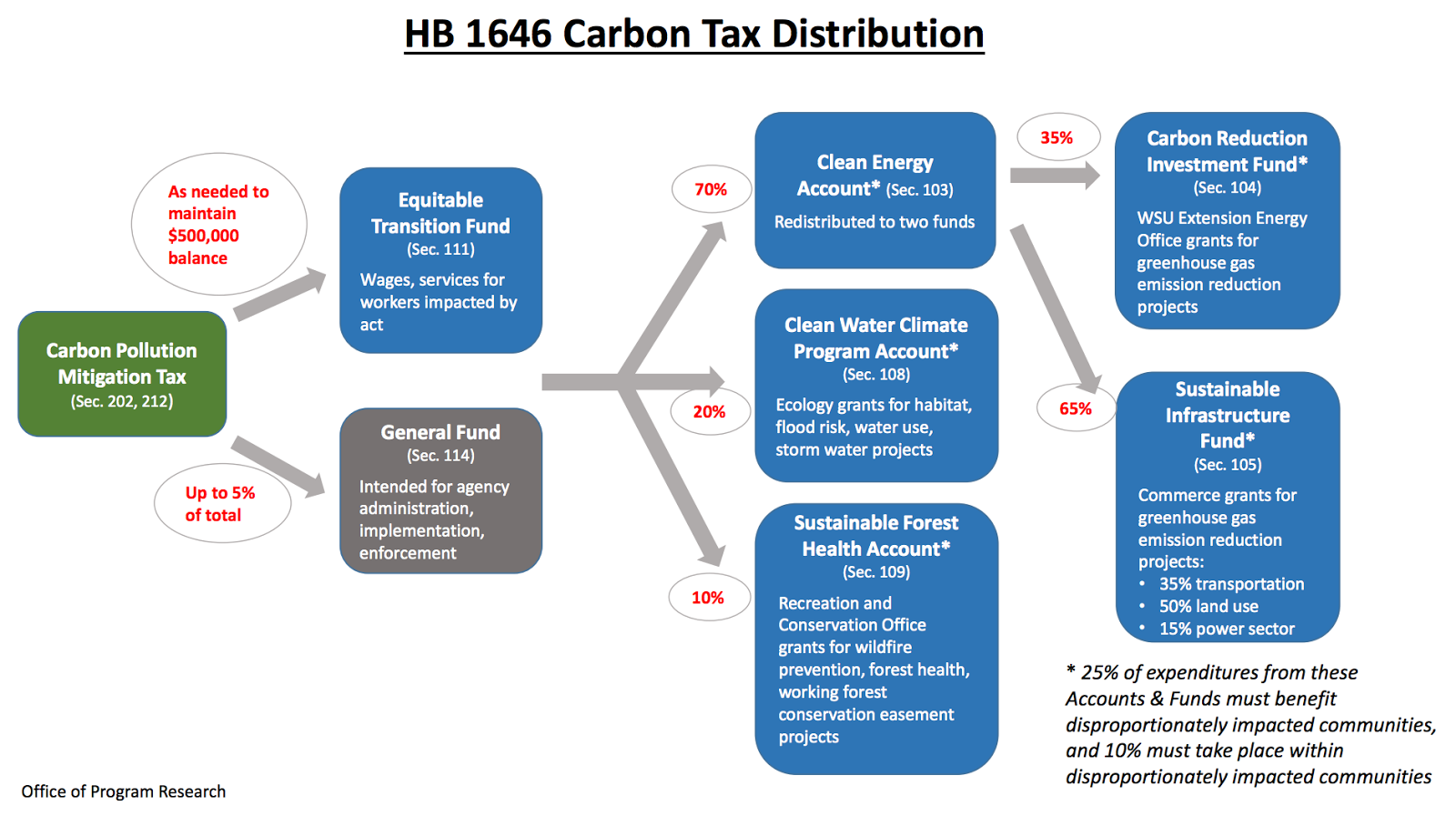

On March 14th the House Environment Committee considered House Bill 1646, titled “Promoting an equitable clean energy economy by creating a carbon tax that allows investment in clean energy, clean air, healthy forests, and Washington’s communities.” The bill imposes a $15/tCO2-equivalent carbon tax, increasing up to seven percent annually depending on progress toward hitting new greenhouse gas reduction targets. The complex chart below by the Office of Program Research, summarizes the myriad of ways revenue (estimated to be $2.4 billion in the 2019-21 biennium) is distributed:

The hearing provided an opportunity for Washington Business Alliance to showcase its new modeling tool: The Carbon Policy Explorer. Given the complex revenue distribution and uncertainty about the cost effectiveness of many of the investments called for in the bill, the Business Alliance modeled two scenarios to establish a likely range of outcomes. Read the full bill analysis here

The Carbon Policy Explorer was recently reviewed by the Washington Departments of Commerce and Ecology, who looked “under the hood” to review the assumptions and jointly concluded that the model has appropriate and transparent assumptions based on sound data. The tool is highly customizable, allowing for real time analysis of revenue implications, price impacts, and carbon reduction outcomes.

Contact the Business Alliance today and set up a presentation of the GHG Reduction Explorer for your business or organization.

Career and Technical Education

Comparing the First Rounds of Senate and House Ed Budgets from a CTE Lens

Operating Budgets

CTE received millions of new dollars for equipment, staff training, and course equivalencies in the Senate budget, thanks to Senator Braun (SB 5853).

Senator Shelly Short from Eastern Washington doubles the funding in the Senate Operating Budget for the CTE Student Leadership Organizations in a floor amendment on March 24th to support programs like Future Farmers of America.

Today the House is having a floor debate and vote on their Operating Budget, which may include CTE related amendments.

Both budgets increase dollars to CTE. However, CTE advocates hope to raise the floor in the House version.

The Senate’s Capital budget includes $30 million for CTE program construction and the House’s Capital budget will be released April 3rd.

Specific Bills that support funding of CTE

Core Plus is a curriculum program that started in Aerospace and then was modified for many types of Advanced Manufacturing. Currently a Maritime-specific curriculum is being written and Construction is scheduled next. The House Operating Budget cut $400K to Core Plus during this 2-year budget cycle. In comparison, the Senate kept the funding for curriculum and staff development at $900K.

HB 1600, which focuses on Work Based Learning (internships and apprenticeships) for all high school students, is included in the House budget and had a hearing in Senate Ways & Means on March 30th. This component of learning is a critical way to allow kids to explore opportunities in a workplace and connect businesses to our education system.

Time is of the essence. Particular Representatives need to hear of the importance of CTE for our businesses to raise the House CTE funding to match the Senate proposals and implement the accountability in Capital Budgets.

Rep. Frank Chopp (frank.chopp@leg.wa.govRep. Pat Sullivan (pat.sullivan@leg.wa.govRep. Kristine Lytton (Kristine.Lytton@leg.wa.govTimm Ormsby (timm.ormsby@leg.wa.gov

Please contact Jene Jones for more information. Jene@wabusinessalliance.org